The recent elevation of the Luxury Car Tax threshold by the Federal Government could potentially translate to savings ranging from $1325 to $1530 for Australian new-car consumers.

The Luxury Car Tax (LCT) threshold will see one of its most significant hikes in over a decade, potentially translating into savings of up to $1520 for new car buyers, excluding additional reductions from stamp duty charges.

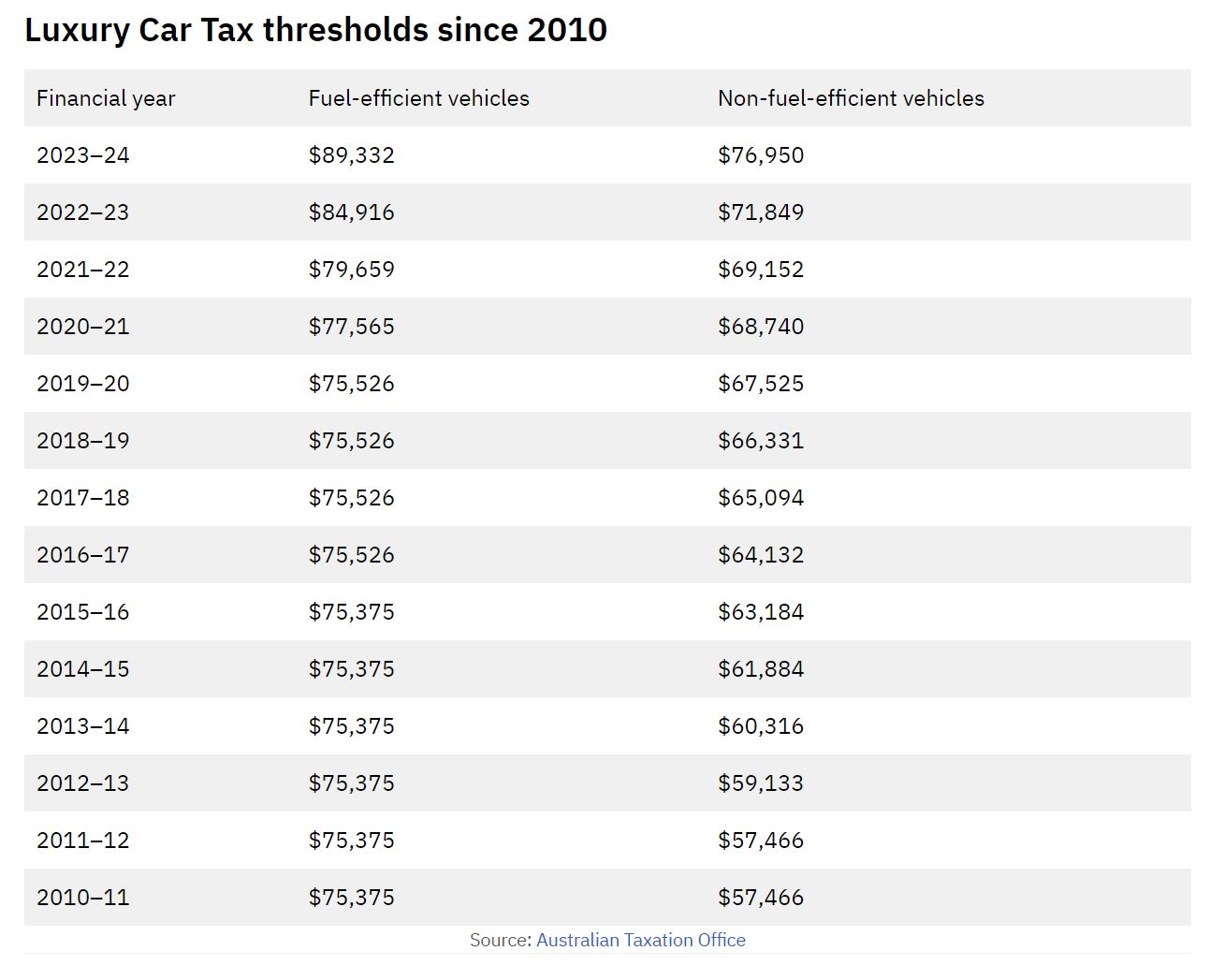

Starting from July 1 of the 2023-24 fiscal year, the LCT threshold will witness an increment of 7.1% for vehicles with advertised fuel consumption rates exceeding 7.0 liters per 100 kilometers. Furthermore, the bracket of "fuel-efficient vehicles", defined as those reporting less than 7.0L/100km fuel consumption, inclusive of electric vehicles, is predicted to ascend by 5.2%.

The LCT, a 33% tariff on each dollar over the threshold, will now be levied on non-fuel-efficient vehicles starting from $76,950 (an increase from $71,849), and $89,332 for fuel-efficient vehicles (an increase from $84,916).

The practical implication of this policy adjustment is that purchasers of certain standard vehicles priced above the old and new LCT thresholds can anticipate tax savings up to $1520, while buyers of fuel-efficient vehicles might save up to $1325.

While the LCT threshold hike for fuel-efficient vehicles this year doesn't surpass the record increment of last year, the threshold uplift for non-fuel-efficient models marks the largest in this vehicle category over the last decade.

This change will also influence the calculation of stamp duty, as it is determined post the application of LCT. Consequently, this will decrease the amount new car buyers need to shell out to their respective state or territory governments when buying a new vehicle.

The LCT is imposed on the vehicle's base price, inclusive of the dealer delivery charge, which can range between $1000 and $4000, along with any optional extras.

According to Drive’s research, there are at least eight 'fuel-efficient' new cars, including the Tesla Model 3 Performance electric car, that may no longer be subject to the new LCT threshold. Nevertheless, optional equipment and metallic paint could push them back over the updated limit.

On a similar note, approximately 55 non-fuel-efficient vehicles will be affected by the revised LCT, with their respective listed prices, excluding dealer delivery charges, now falling under the new threshold.

Despite the Federal Government's projection of an almost 36% drop in Luxury Car Tax revenue, from a record $1.14 billion to $840 million between the 2022-23 and 2024-25 fiscal years, it has yet to express intentions to completely scrap the Luxury Car Tax. This is despite persistent lobbying from the auto industry, arguing that the tax was originally introduced to safeguard local car manufacturing which ceased six years ago.